LIC New FD Scheme 2025: Is It the “Safe Haven” You’ve Been Looking For?

Let’s be honest. If you live in an Indian household, the word “LIC” isn’t just a brand name—it’s an emotion. It’s right up there with “beta, sweater pehen lo” and “log kya kahenge.”

Recently, my neighbor, let’s call him Sharma Uncle (because there’s always a Sharma Uncle), came running to me with a sparkle in his eye. “Beta, LIC has launched a new FD! Guaranteed returns! Better than the bank!” he exclaimed, clutching a pamphlet that looked like it had been forwarded on WhatsApp about fifty times.

I had to pause his excitement for a second. “Uncle, hold on. Are we talking about an actual Fixed Deposit, or another insurance plan disguised as a golden goose?”

That’s the confusion, isn’t it? Everyone is searching for the “LIC new FD scheme,” but half the time, they don’t know if they are buying a deposit or a policy.

If you’re sitting on a lump sum of cash—maybe a bonus, a property sale, or just savings you hid from your spouse (I won’t judge)—and you’re wondering where to park it, you’ve come to the right place.

Let’s dive into the real details of the LIC “FD” schemes in 2025, separate the myths from the math, and figure out if this is the right place for your hard-earned money.

First Things First: The “Real” FD vs. The “Insurance” FD

Before we talk rates, we need to clear the air. When people say “LIC FD,” they usually mean one of two very different things:

-

The Actual FD: This is the LIC Housing Finance Ltd (LIC HFL) Sanchay Public Deposit. It works exactly like a bank FD. You put money in, you get interest, you take money out. Simple.

-

The “FD-Like” Insurance Plan: These are single-premium policies (like LIC Jeevan Utsav or Jeevan Shanti) where you pay once and get “guaranteed returns” for life.

Which one is right for you? Well, that depends on whether you want your money back in 3 years or if you want a pension until you’re 99. Let’s break them down.

1. The Real Deal: LIC Housing Finance (LIC HFL) Sanchay Deposit

If you want a pure investment where your money grows without any “life insurance” strings attached, this is it.

The 2025 Interest Rates (The Juicy Part)

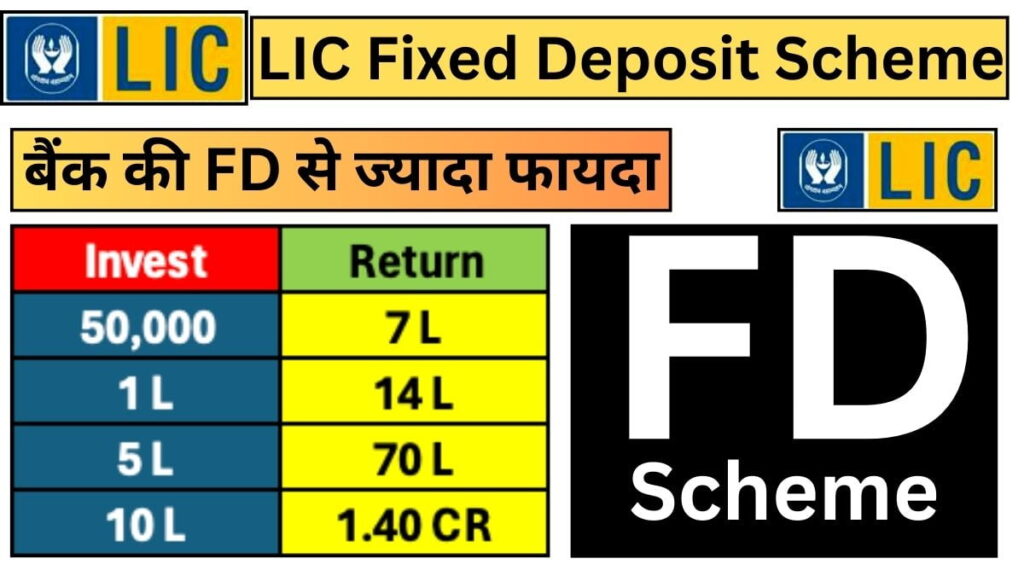

As of late 2025, LIC HFL has kept their rates pretty competitive to fight off the banks. Here’s what the Sanchay Public Deposit looks like:

-

1 Year: ~6.70% p.a.

-

18 Months: ~6.75% p.a.

-

3 – 5 Years: ~6.85% – 6.90% p.a.

-

Senior Citizen Bonus: Grandma gets an extra 0.25%, pushing the top rate to around 7.15%.

(Note: Rates fluctuate, so always check the official website before writing that cheque!)

Why Should You Care? (The Pros)

-

Safety Rating: These deposits are usually rated AAA/Stable by agencies like CRISIL. In plain English? It’s highly unlikely they’ll run away with your money. It’s as safe as Sharma Uncle’s old scooter.

-

Flexibility: You can choose between Cumulative (interest is added to your principal and paid at the end) or Non-Cumulative (you get interest payouts yearly to pay your bills).

-

Loan Facility: Broke? You can take a loan against this FD (up to 75% of the amount) without breaking it.

The “Gotcha” Moments (The Cons)

-

Taxable: Sorry to burst the bubble, but the interest is fully taxable. If you’re in the 30% tax bracket, that 6.90% return starts looking a lot like 4.8%. Ouch.

-

No Section 80C: Unlike a 5-year Tax Saving Bank FD, this corporate FD doesn’t give you a tax deduction on the principal.

2. The “Hidden” FD: LIC Jeevan Utsav & Single Premium Plans

This is usually what the insurance agents are pitching when they say, “Sir, FD se better hai!”

What Is It?

Plans like LIC Jeevan Utsav are creating a lot of buzz in 2025.

-

How it works: You pay a lump sum (Single Premium) or pay for a few years.

-

The Return: They promise a guaranteed income of 10% of the Sum Assured annually for life.

Why People Love It (The “Masala”)

-

Tax-Free Returns: This is the killer feature. Under current tax laws (Section 10(10D)), the maturity/income benefit is often tax-free if your premium is within certain limits (usually up to ₹5 Lakh aggregate).

-

Life Cover: God forbid something happens to you, your family gets the Sum Assured. An FD won’t do that; an FD just gives your nominee the money back.

-

Locked & Loaded: The rate is locked for life. If interest rates drop to 3% in 2030, LIC still has to pay you what they promised.

The “But…”

-

Liquidity Trap: You can’t just walk in and withdraw your money next year like an FD. It’s a long-term marriage, not a casual date. Surrendering early means losing money.

Head-to-Head: LIC HFL FD vs. LIC Insurance Plans

Still confused? Let’s put them in a boxing ring.

| Feature | LIC Housing Finance FD (Sanchay) | LIC Insurance Plans (Jeevan Utsav/Shanti) |

|---|---|---|

| Primary Goal | Short to Medium Term Growth | Long Term Income + Life Cover |

| Returns | ~6.90% – 7.15% (Guaranteed for tenure) | ~5% – 6% XIRR (Internal Return) |

| Taxation | Fully Taxable (As per slab) | Tax-Free (Mostly, subject to conditions) |

| Liquidity | High (Withdraw anytime with penalty) | Low (Lock-in periods apply) |

| Best For | Parking cash for 1-5 years | Retirement income & Legacy planning |

How to Apply for the LIC HFL FD (Without Losing Your Mind)

If you’ve decided the Sanchay Deposit is for you, you don’t need to stand in a queue holding a token.

-

Go Online: Visit the official LIC Housing Finance website. Look for the “Public Deposit” section.

-

KYC is King: You’ll need your PAN Card and Aadhaar. (Seriously, do we do anything without Aadhaar anymore?)

-

Cheque It: You might need a cancelled cheque to link your bank account for payouts.

-

The Courier Step: Sometimes, even if you apply online, they might ask you to courier the physical form or visit a local center. Classic semi-digital India, right?

FAQs: Answering the “Sharma Uncle” Questions

Q: Is the LIC FD 100% safe?

A: Technically, only Bank FDs have insurance up to ₹5 Lakh (DICGC). Corporate FDs like LIC HFL are “Unsecured.” However, LIC HFL has strong backing and high credit ratings (AAA). It’s considered one of the safest corporate FDs in the market.

Q: Can I get a monthly interest payout?

A: No, the LIC HFL Sanchay scheme usually offers Annual interest payouts for the Non-Cumulative option. If you want monthly income, you might want to look at the Post Office MIS or specific Bank FDs.

Q: Is the interest rate higher than SBI or HDFC?

A: Generally, yes! Corporate FDs (like LIC HFL, Bajaj Finance, Shriram) almost always offer 0.50% to 1.00% higher interest than standard big banks to attract depositors.

Q: What happens if I close the FD early?

A: There’s a lock-in period of 3 months. You can’t withdraw before that. After 3 months, if you withdraw, the interest rate drops significantly (usually 2-3% lower than the card rate) as a penalty.

Final Verdict: Should You Invest?

Here’s my honest take.

If you are in the 10% or 20% tax bracket and you want a safe place to park money for 3-5 years to buy a car or fund a wedding, the LIC Housing Finance FD is a solid winner. It beats the bank rates and carries the trust of the LIC brand.

But…

If you are in the 30% tax bracket, that FD interest is going to get eaten by taxes. You might be better off looking at the Insurance Plans (like Jeevan Utsav) for tax-free income or sticking to Debt Mutual Funds if you want liquidity.

So, what’s it going to be? Are you Team FD or Team Insurance?

By the way, if you do open an FD, maybe tell your neighbors about it. Just make sure you explain the difference so they don’t end up buying a 20-year policy when they just wanted to save for a vacation!