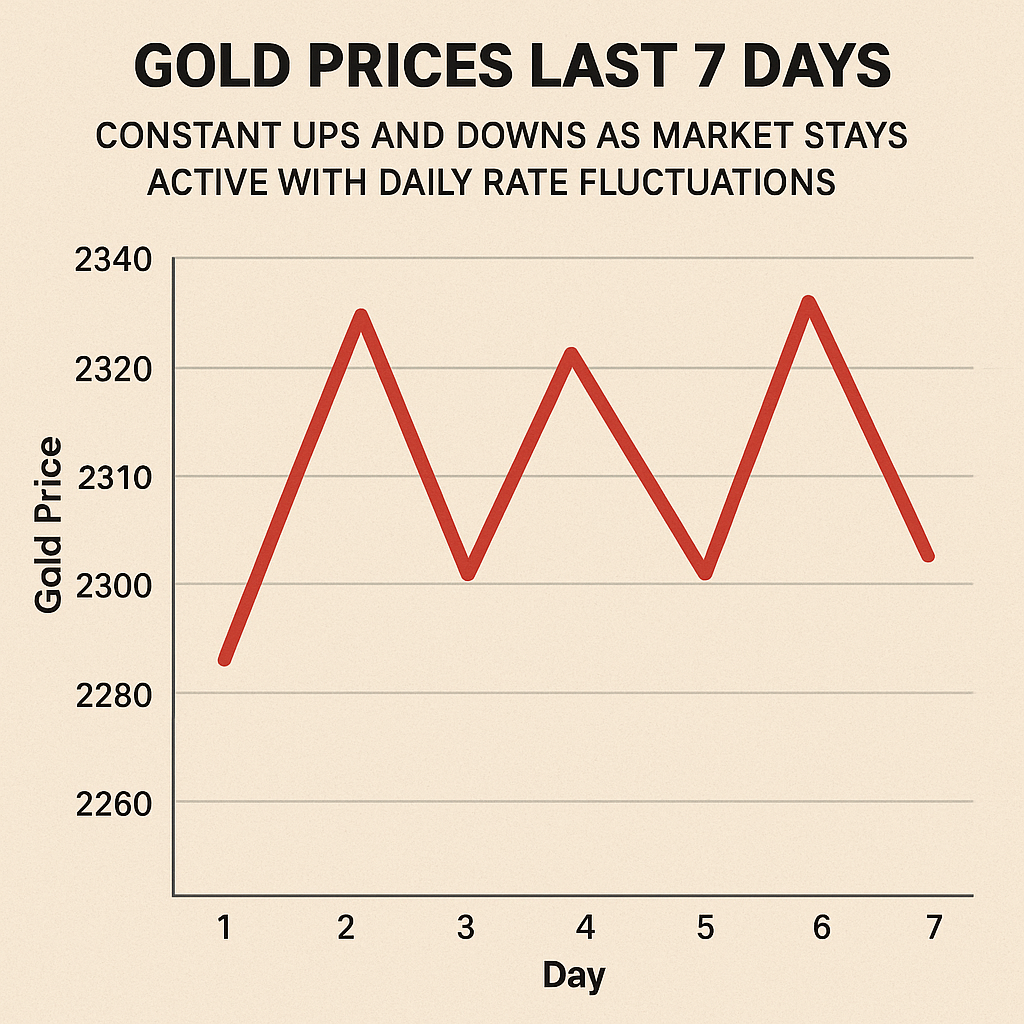

Gold Prices Last 7 Days Show Constant Ups and Downs as Market Stays Active With Daily Rate Fluctuations

Gold prices in the last seven days have shown steady movement with small ups and downs depending on global market trends. Investors and buyers closely follow these daily rate changes to decide the best time for purchasing. Over the week, both 22K and 24K gold rates fluctuated within a narrow range, reflecting demand, currency value, and international gold prices. These short-term changes are normal and help predict future trends. For those planning to buy jewellery or invest, checking the 7-day gold rate gives a clear idea of how the market is moving and when prices may rise or fall.

1. Small Daily Price Fluctuations

Throughout the week, gold prices moved slightly up and down. These variations are common and usually depend on global factors like economic news, inflation, and international gold demand.

2. 22K and 24K Both Showed Similar Trends

Both purity levels—22K and 24K—displayed almost identical movement. When 24K gold increased, 22K followed, making it easier for buyers to judge market behaviour accurately.

3. Narrow Price Range Indicates Stability

The difference in prices across the seven days stayed within a limited range. This shows that the market was relatively stable and did not experience any major spikes or drops.

4. Useful for Short-Term Buyers

People planning to buy jewellery soon can rely on this 7-day trend to make smarter decisions. Watching daily movement helps identify the most affordable day to purchase gold.

5. Influenced by Global Market and Currency Value

Changes in international gold rates and the value of the Indian rupee had a direct impact on daily prices. These external factors mostly controlled whether the price moved up or down during the week.

Gold prices over the last 7 days have been on a wild rollercoaster, dipping and spiking like a caffeine-fueled heartbeat. If you’re eyeing that wedding band or just hedging against life’s curveballs, these daily fluctuations keep the market buzzing with action. From MCX highs near ₹1,30,000 per 10g to slight pullbacks, it’s got investors glued to their screens.

Honestly, watching gold dance like this reminds me of my first big buy back in 2020—prices yo-yoed, and I sweated bullets timing it. Today, with global cues and rupee wobbles, the gold rate trend last 7 days screams opportunity mixed with caution. Let’s unpack the chaos.

Gold Price Rollercoaster: Day-by-Day Breakdown Last 7 Days

Buckle up—this week’s daily gold price fluctuations read like a thriller plot. We’re talking 24K gold per 10 grams in India, pulled from live market data as of December 10, 2025. Prices hovered around ₹1,29,000-₹1,33,000, with ups, downs, and teases of records.

December 10: Slight Dip Holds Steady

Today, 24K gold sits at ₹1,29,430 per 10g (₹12,943/g), down a whisper from yesterday’s close. 22K? ₹1,18,640 (-₹10). Markets cooled after a Fed-watch frenzy, but demand from jewelers kept it afloat.

Feels like the metal caught its breath—perfect for buyers waiting out peaks.

December 9: Minor Uptick

₹1,31,932 for 24K (up ₹1,327 from prior). 22K hit ₹1,20,850 (+₹1,164). Global gold touched $4,212/oz, buoyed by rate-cut hopes. By the way, MCX futures flirted with resistance at ₹1,30,713.

December 8: Small Pullback

24K eased to around ₹1,33,259? Wait, data shows volatility—down ₹117 for 24K in some trackers. Support held at ₹1,29,354, with traders eyeing weekly pivots.

Like a boxer dodging punches, gold bobbed but didn’t drop hard.

December 5-7: Weekly Highs Tease

Mid-week surge: December 5 saw 24K at ₹1,33,142 (+₹852), peaking near current week high of ₹1,30,764. Fluctuations averaged ₹400-₹1,300 daily swings. Domestic buying fueled the fire.

Earlier Days (Dec 4-3): Building Momentum

Dec 4: ₹1,32,290 (+₹823). Dec 3: ₹1,33,113 (+₹423). These jumps screamed bullish, with one-week high at ₹1,29,032 testing barriers.

Here’s the snapshot table for gold prices last 7 days India (24K/10g, approx.):

| Date | 24K Price (₹/10g) | Change | 22K Price (₹/10g) |

|---|---|---|---|

| Dec 10 | 1,29,430 | -₹100 | 1,18,640 |

| Dec 9 | 1,31,932 | +₹1,327 | 1,20,850 |

| Dec 8 | 1,33,259 | -₹117 | 1,22,014 |

| Dec 5 | 1,33,142 | +₹852 | 1,21,958 |

| Dec 4 | 1,32,290 | +₹823 | 1,21,178 |

| Dec 3 | 1,33,113 | +₹423 | 1,21,932 |

| Dec 2 | 1,32,690 | +₹477 | 1,21,543 |

Net: Up ~1-2% weekly, but those constant ups and downs kept it spicy.

Why the Heck Are Gold Prices Fluctuating Daily?

Gold’s like that unpredictable friend—thrilling but exhausting. Last week’s gold rate daily fluctuations stem from a cocktail of global and local triggers. US Fed rate-cut buzz pushed spots to $4,212/oz, up 0.54% daily at times.

Rupee dips amplified import costs, while India’s festival tailwinds and wedding season juiced demand. Geopolitics? Always lurking, making safe-haven gold twitch. Honestly, it’s a trader’s paradise, buyer’s puzzle.

MCX trends show pivot at ₹1,29,907—break above? Rally to ₹1,30,500. Below? Test ₹1,28,548. Classic volatility play.

My Wild Ride with Gold Price Swings

Flashback: Last Diwali, prices jumped ₹2,000 in 48 hours—I panicked-sold a sliver, regretting it when it climbed back. This week’s dance? Eerily similar. I track via apps now, nabbing dips like Dec 10’s soft landing.

Humor alert: Feels like dating gold—chase highs, get burned; wait for lows, score big. My tip from years watching: Average in during these 7-day gold price trends, not all-in on peaks. Saved my portfolio sanity.

Compared to stocks, gold’s steady chaos is comforting—like a reliable storm.

City-Wise Gold Rates: Where’s the Best Deal?

Fluctuations vary by hub. Delhi/ Mumbai hover ₹1,29,000-₹1,30,000 (24K/10g); Hyderabad/ Patna mirror with minor premiums. Check local jewelers—making charges add 5-15%.

-

Tier-1 (Delhi, Mumbai): ₹12,943/g today—high volume, tight spreads.

-

Tier-2 (Hyderabad): Similar, but watch GST tweaks.

-

Rural spots: Often ₹100-200 premium due to logistics.

Pro hack: Digital gold (Groww/PhonePe) skips making fees, tracks spot perfectly.

Gold vs Silver: The Sidekick Story Last Week

Silver tagged along, up ~1.5% but choppier. While gold hit ₹1,33k peaks, silver flirted ₹90k/kg. Dual play? Gold’s stability wins for portfolios.

Analogy: Gold’s the wise elder; silver, the energetic kid—both fluctuate, but gold steadies the ship.

Investment Angles: Buy, Sell, or Hold Amid Fluctuations?

With active gold market daily rate fluctuations, timing’s tricky. Bullish cues: Fed cuts, inflation fears. Bearish: Strong dollar pullbacks.

Strategies:

-

SIP in gold ETFs—average those ups/downs.

-

Sovereign Gold Bonds—8% interest + tax perks.

-

Coins/bars for physical peace.

My opinion: Last 7 days signal buy-on-dip around ₹1,28,500 support. Long-term? Gold’s up 56% YoY—don’t sleep.

Risks? Overbought signals near ₹1,30k resistance. Diversify, folks.

Global vs India: The Big Picture

International gold at ~$4,212/oz translates to ₹1,00,000+/10g base, plus duties. India’s premium? Festive demand. Last week, global +0.54% daily mirrored local jigs.

US elections, Middle East tensions—global ripples hit MCX hard.

Tools to Track Gold Price Trends Yourself

Don’t wing it:

-

GoodReturns/GoodPriceIndia: Daily tables, city rates.

-

MCX App: Live futures, pivots.

-

Groww: Historical charts, buy buttons.

Set alerts for ₹1,29k zones—beats FOMO.

Common Mistakes in Volatile Gold Markets

-

Chasing peaks: Dec 9 surge? Many bought high, sold low.

-

Ignoring purity: Stick 24K/22K benchmarks.

-

Forgetting taxes: 3% GST + TCS over ₹2L.

Lesson from my loss: Paper trade first during gold price ups and downs last week.

Future Outlook: What’s Next After 7-Day Volatility?

Experts eye ₹1,30,500 if resistance cracks; downside ₹1,25,300. Wedding peak + budget vibes could stabilize. Positive medium-term—hold steady.

FAQs: Gold Prices Last 7 Days Quick Hits

What was the highest gold price last 7 days?

~₹1,33,259 (Dec 8/5), 24K/10g.

Lowest in the week?

Around ₹1,29,430 today (Dec 10).

Why the daily ups and downs?

Fed expectations, rupee moves, demand spikes.

Gold rate today per gram?

₹12,943 (24K).

Should I buy now amid fluctuations?

Dip-buy near supports; average for safety.

Ride the Gold Wave Smarter

These gold prices last 7 days constant ups and downs prove the market’s alive, kicking, and full of stories. From my scrapes to triumphs, volatility’s where fortunes brew—if you play smart.